ROAD TO PRACTICE:

Illinois

1. Join State Association

Application page

- https://catalog.ilchiro.org/Search/MembershipTypesList

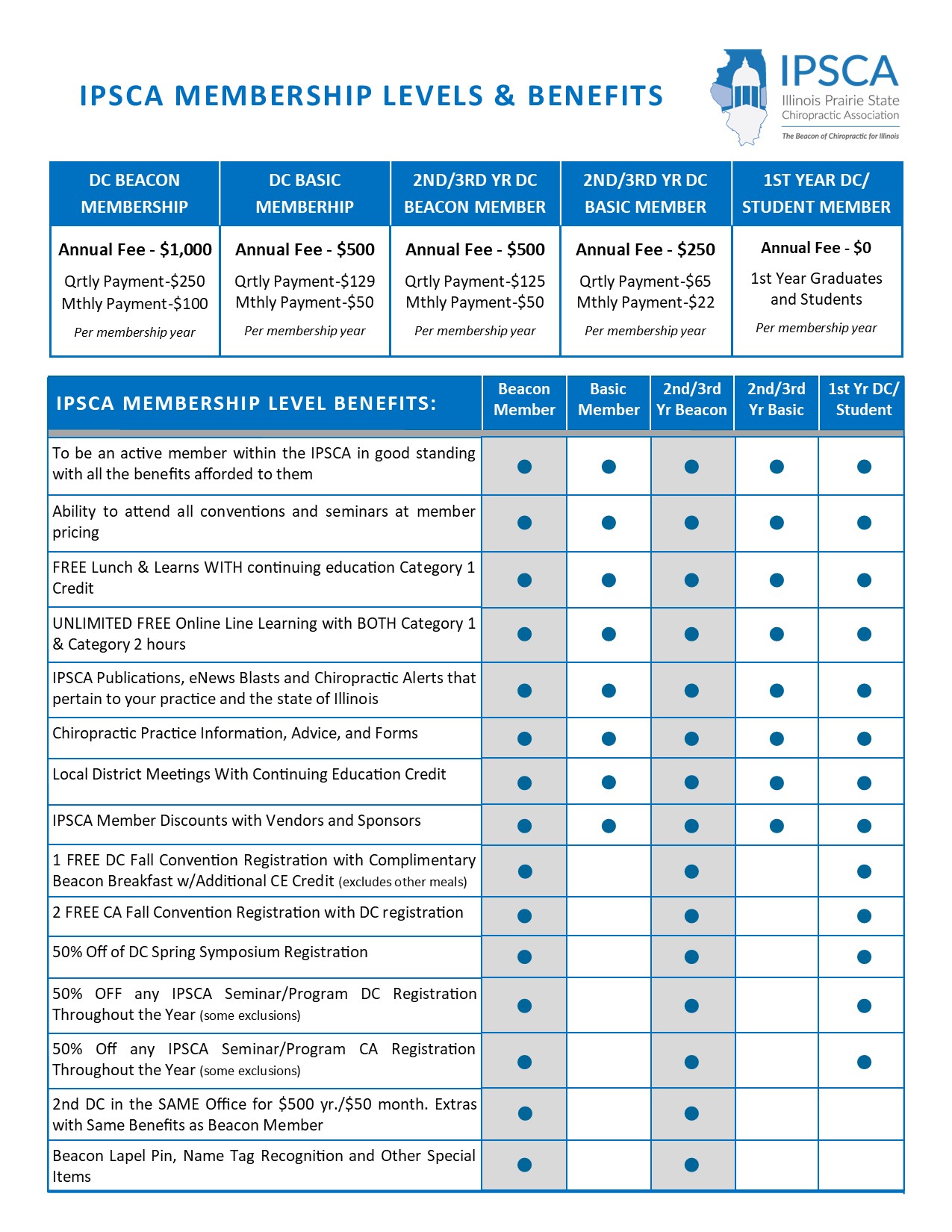

- Membership rates are pro-rated for those in their first three years of practice. Then tiered membership.

- Students: free

Member benefits summary

- Based on membership tier, may include conference and seminar registration fees.

- Other access to webinars and educational tools included.

- Access to Illinois Practice Edge and The Advantage, two different texts that provide the latest information about concerns in the state and elsewhere around reimbursement, documentation, compliance, and more.

- Exclusive discounts for members on entertainment and travel

- Supply discounts

- Find-a-doc directory

- Templates for a variety of forms required for practice and business use

- There are some noteworthy details about advertising physical therapy and/or billing occupational health as a chiropractor, the state association further provides guidelines on these gray areas of practice.

Advocacy efforts

Proven track record with bringing limitations to insurance recoupment, adding chiropractic to the Medical Practice Act, and including chiropractic on the state board of health, plus more!

Application page

2. License Requirements

Applying for a License

- https://idfpr.illinois.gov/profs/chiropractor.html

- Exam scores

- Transcript – official

- Signed authorization for third-party review

- Good moral character (questionnaire)

- Some clerkship documentation may be required

- If previous licenses: date of previous license(s), and any disciplinary documentation, if relevant

- Documentation of “professional capacity” if license application is from one who was not in a medical program 2 years prior to the application.

- Fee: $543 – *as of this writing, 2022-2024 renewal fees are waived to acknowledge frontline healthcare workers.

- NBCE Part I, II, III, IV

- Background check required, including fingerprinting

- Triennial renewal

- Education from a fully accredited CCE school

- Non-accredited CCE schools (ie/ foreign colleges) must have an additional two years of academic study around clinical sciences

(Students may apply/sit for exam prior to graduation, and finalize application once graduated/received final transcript.) - NBCE Physiotherapy and Acupuncture boards accepted

Acupuncture is within the scope of practice, without a specified number of hours of education. If investigated, an expert testimony of abilities may be useful. - NBCE SPEC exam utilized only to reinstate licenses due to inactivity of 3+ years

- May be used to endorse license application

- Travel to Treat not authorized

- Telemedicine not authorized

State Scope of Practice

- “Treatment of human ailments without the use of drugs and without operative surgery, pursuant to the Medical Practice Act (225 ILCS 60/)”

- Housed within the state Medical Board

- Further regulatory info: https://www.ilga.gov/commission/jcar/admincode/068/06801285sections.html

CEU (for renewal) requirements

- 150 hours every 3 (three) years

- 1 hour CE on sexual boundaries or sexual harassment prevention training

- 1 hour implicit bias training in healthcare

- PACE CEUs not accepted.

3. Getting Your NPI Number

(New Practioner Identification) Number

Step by step instructions

https://www.nata.org/sites/default/files/apply_npi_instructions.pdf

4. Obtaining an EIN

Step by step instructions

https://sa.www4.irs.gov/modiein/individual/index.jsp

Note: This is your tax ID number as a practitioner

State specific rules

- Filing for a business

- https://www.ilsos.gov/departments/business_services/home.html

- This link has online services to file for and apply for LLCs and other legal business entities.

- Reserve a name – must be unique

- Assign registered agent

- Registered office – street or road address, or rural route and PO box number for location – you cannot have just a PO box

- Fees to file are based on a 10 business-day period, you can pay a greater fee to have business documents finalized in 24 hours.

- FinCEN required (federally) with reporting

Type Of Business Breakdown

|

Business Structure |

Ownership |

Liability |

Taxes |

|

Sole Proprietorship |

One person |

Unlimited personal liability |

Personal tax only |

|

Partnership |

Two or more persons |

Unlimited personal liability unless structured as a limited partnership |

Self-employment tax (except for limited partnership), Personal tax |

|

Limited Liability Company (LLC) |

Two or more persons |

Owners are not personally liable |

Self-employment tax, Personal tax or Corporate tax |

|

Professional Limited Liability Company (PLLC) |

Two or more persons |

Owners are not personally liable |

Self-employment tax, Personal tax or Corporate tax |

|

Corporation – C Corp |

One or more persons |

Owners are not personally liable |

Corporate tax |

|

Corporation – S Corp |

One or more persons, but no more than 100 and all must be US citizens |

Owners are not personally liable |

Personal tax |

|

Corporation – B Corp |

One or more persons |

Owners are not personally liable |

Corporate tax |

|

Corporation – Nonprofit |

One or more persons |

Owners are not personally liable |

Tax-exempt, but corporate can’t be distributed |

Note: The difference between an LLC and a PLLC is that all members of a PLLC are required to be designated professionals.

What is an Associate?

An associate receives pay from the office by which they are employed. If you are an associate who will be dealing with vendors for selling goods, you should consider getting an EIN.

What is an independent Contractor?

An independent contractor receives pay from their patients and insurance companies directly. If you are an independent contractor, you need an EIN.

Things to be aware of related to taxes

Learn more about local tax variations and pay state/local taxes: https://taxfoundation.org/location/wyoming/

5. Obtaining Malpractice Insurance

Malpractice Insurance Providers

-

NCMIC – https://www.ncmic.com/malpractice-insurance/how-to-apply-online/

-

ChiroSecure – https://www.chirosecure.com

-

General Liability Insurance – https://generalliabilityinsure.com/small-business/chiropractic-insurance.html

-

ChiroFuture – https://chirofutures.org/online-quote/

-

SDN Insurance – http://sdnins.com/chiropractor.html

-

CoverMD – http://www.covermd.com/chiropractor-malpractice-insurance.aspx

-

Insureon – https://alliedhealth.insureon.com/resources/cost/chiropractic

-

MBS Insurance Services – https://www.mbsinsure.com/solutions/malpractice-insurance/

-

USA Business Insurance – https://www.businessinsuranceusa.com/chiropractor-professional-liability-insurance

-

CM&F – https://www.cmfgroup.com/professional-liability-insurance/chiropractic-assistant-insurance/

-

MACARIO Insurance Group – https://www.macarioinsurance.com/who-we-cover/all-classes-of-business/

-

Chiroprefered – https://chiropreferred.com/find-the-right-coverage

Claims Made

A policy providing coverage that is triggered when a claim is made against the insured during the policy period, regardless of when the wrongful act that gave rise to the claim took place. (The one exception is when a retroactive date is applicable to a claims-made policy.)

Occurrence

An occurrence policy covers claims resulting from an injury or another event that occurs during the policy term. Coverage depends on the timing of the event. A claims-made policy covers claims that are made during the policy period.

Tail Coverage

An addition to a claims-made policy. It extends coverage for incidents that happened during the time you had your policy, but a claim was not filed until after your policy expired or was canceled. Tail coverage is another name for an extended reporting period.

Note: $1 Million/$3 Million is the minimum plan required in order to participate with some Insurance Companies.

6. Participating with Insurance Providers

- Common insurance companies include United Health Care, BlueCross BlueShield of Illinois, Aetna, Cigna, Molina, and HealthAlliance. Links below allow you to apply for participation in their networks.

- UHC (viaOneHealth) https://www.uhcprovider.com/en/resource-library/Join-Our-Network.html

- BCBS of IL: https://www.bcbsil.com/provider/network/network/join-bcbsil-network

- Aetna: https://www.aetna.com/health-care-professionals/join-the-aetna-network.html

- Cigna: https://www.cigna.com/health-care-providers/credentialing/join-medical-network

- Molina (Medicaid) https://www.molinahealthcare.com/providers/il/medicaid/comm/Join-Our-Network.aspx

- Health Alliance: https://provider.healthalliance.org/

- ERISA policy – these are self-funded plans provided by private employers. These plans exclude Medicare, Medicaid, public school, workers compensation, military, church or other individual private insurances.

- There are various laws that allow appeals for denial of these claims as they often follow their own fee-schedule or processes for claims.

- These policies look different than most private insurers, and more information on processes and participating with these policies can be found within ICS guidelines for members.

- As of this writing, most private insurance companies rely on CAQH to verify your credentials. You will also need CAQH credentialing for some of the government supplemented participations. Others will use Availity for your credentialing. Keep in mind, you only need one account on either of these, and then will give permissions to each insurance company you are working to participate with to be verified.

- https://www.availity.com/essentials

- CAQH: information needed https://proview.caqh.org/Login/

- NUCC Grouping: Chiropractic Providers

- Provider type: Doctor of Chiropractic

- Select your state

- Social security number

- Demographics and contact information

- License number(s) and state(s)

- Educational information (about your chiropractic school and degree)

- Board certified: No (chiropractors are not board certified, and do not need to be)

- You may select directory listings and other searchable tags

- Practice locations including TIN

- You may add credentialing contact information if you are using a third party

- Malpractice insurance information: company, expiration dates, and policy numbers.

- 10 year work history, dates, addresses, etc.

- Professional disclosures

- Documents to upload:

-

-

- Standard authorization release; updated every 120 days

- Professional liability insurance verification (proof of insurance)

- State license (copy)

- W9

-

-

Medicare Enrollment:

https://www.cms.gov/Medicare/CMS-Forms/CMS-Forms/Downloads/cms855i.pdf

Medicare Revalidation: PECOS:

https://www.youtube.com/embed/PaLEWx0JGPw?rel=0&autoplay=0

Tips For Medicare Audit/Record Request Tips

https://www.acatoday.org/Practice-Resources/Medicare/Medicare-Audit-Record-Request-Tips

Type Of Audit And Record Requests

https://www.acatoday.org/practice-resources/medicare/medicaretpe/

Targeted Probe And Education (TPE)

http://www.acatoday.org/MedicareTPE

Medicare Training For The Chiropractic Office

https://learn.acatoday.org/products/medicare-training-for-the-chiropractic-office

How To Bill Secondary Insurance Plans

https://www.medicare.gov/supplements-other-insurance/how-medicare-works-with-other-insurance

Which Insurance Pays First

https://www.medicare.gov/supplements-other-insurance/how-medicare-works-with-other-insurance/which-insurance-pays-first

Medicaid: administered by the Department of Healthcare and Family Services

- HealthChoice Illinois – a managed care organization (MCO)

- Must enroll for provider to participate

- Handbook: https://hfs.illinois.gov/content/dam/soi/en/web/hfs/sitecollectiondocuments/b200.pdf

- Handbook includes responsibilities of the provider, enrollment guidelines, and department responsibilities.

- Also includes claims and timely filing requirements and how to submit claims electronically

- Fee schedule: https://hfs.illinois.gov/medicalproviders/medicaidreimbursement/chiropracticfeeschedule.html

- Certain information will be required for a claim: read here – https://ilchiro.org/work-comp-pi-basics/

- Overview of many questions around working with WC when faced with normal insurance as well, from Illinois Chiropractic Society: https://ilchiro.org/workers-compensation-and-personal-injury-billing-health-insurance/

- MedPay claims may be filed for personal injuries

- Attorney liens may apply